Many financial institutions like NBFCs, banks and digital lenders provide loans to you besides other financial instruments like credit cards. Such loans are processed just when you as an applicant hold a great credit score. You can approach TransUnion CIBIL’s official site and conduct CIBIL check online. Holding a strong credit score enhances your chances of availing a loan easily at a lower rate of interest. Let’s know in detail what credit score is and its importance.

What’s a credit score?

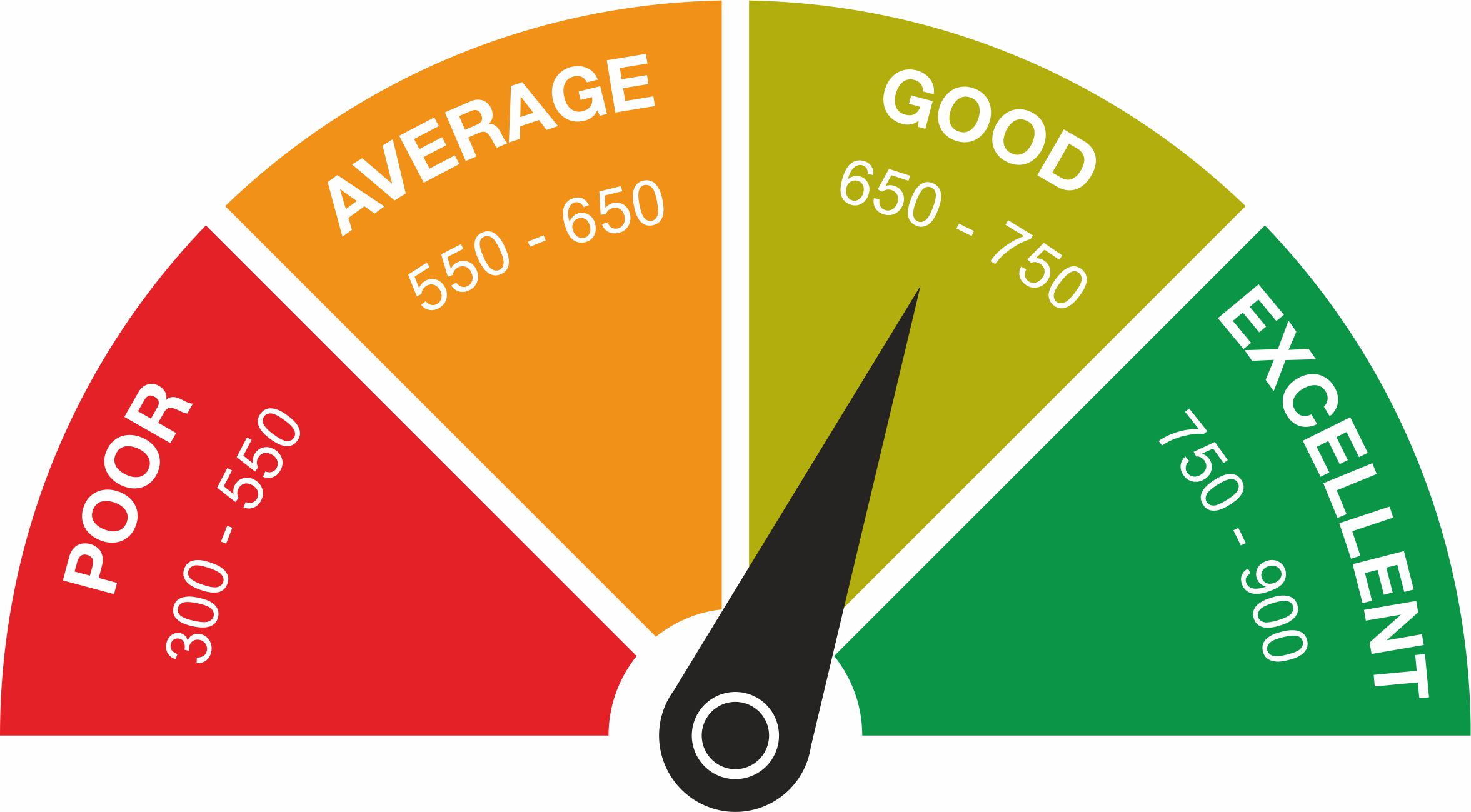

The credit information bureau of India Limited (CIBIL) issues a CIBIL score to you as an applicant that denotes your credibility and your repayment potential for a loan or credit card on time. CIBIL is a 3-digit number computed based on your past credit history. Your CIBIL score range anywhere from 300 to 900 wherein a credit score of 750 is considered as good by creditors and lenders, both. So, whether it is the Bank of India, Axis bank, HDFC bank or SBI credit card, CIBIL score of over 750 is a must to get the best credit card as per your requirement. However, for lenders too having a higher CIBIL score of 750 and above is a must.

Your credit score is determined based on numerous parameters like your repayment history, kinds of credit and loan accounts, opening as well as outstanding loan proceeds, credit history, etc. Distinct financial institutions and banks hold distinct benchmarks to issue loans and credit cards to you as an applicant.

What are the crucial steps for checking your credit score?

Follow the below-mentioned important steps for checking your CIBIL score from any online lending platform –

Step no. 1 – Approach the official website of the online lending platform.

Step no. 2 – Input the listed personal details –

∙ Gender (Female / Male)

∙ Permanent account number (PAN)

∙ Date of birth (DOB) (in DD – MM – YYYY format)

∙ Full name

∙ Mobile number

∙ Email address

∙ PIN code

Step no. 3 – Input the OTP sent to your phone number.

Step no. 4 – Now, tick the checkbox to submit the lending platform with authorization to receive your credit info from the respective credit bureaus.

Step no. 5 – Hit on the button ‘get your score’.

Step no. 6 – Your score will come up on the screen.

Additional Reading: Check CIBIL Score by Pan Card

What’s the importance of the CIBIL score?

CIBIL score is a crucial aspect as it assists you in the listed ways –

CIBIL score assists you as a borrower to know about your credit status. You as an individual who manages your finances well can always hold a higher credit score. A lower credit score shows that you as an applicant hold low credibility and banks avoid giving loans to you as an applicant.

If you as an individual hold a strong CIBIL score, the financial institution might grant you a loan at a reduced rate of interest and with minimal documentation. If your credit score is low, lenders either would not approve your loan application or grant you a loan at a higher interest rate. However, the CIBIL score is not the sole criterion that determines whether financial institutions would grant a loan to you as an applicant.

There are distinct other parameters that assist such organisations to determine the loan application approval. However, your credit score of you as an applicant plays an important role in financial institutions determining your eligible rate of interest and processing charges. You as an applicant must have a higher credit score and might get the loan at a reduced interest rate while others with lower credit scores might avail a loan at a higher interest rate.

What are the benefits of a strong CIBIL score?

A strong CIBIL score makes sure that you have a wide number of benefits over those with zero CIBIL scores or the ones having a lower credit score. You get entitled to the listed benefits if you hold a strong CIBIL score –

Easy and swift credit from the lenders –

A strong CIBIL score assists you in availing loans and credit cards from financial institutions very easily because your excellent credit score enhances the hopes of the lenders that you would simply repay your loans timely.

Instant loan approval –

A strong CIBIL score mentions that you are a great prospect to lend money. Thus, banks try and endow you with a loan as quickly as possible. You as an individual having a lower score must furnish the required documents and may have to apply with the guarantor as the disbursal process in such a scenario may be low.

Low rate of interest credits –

If you are an individual with a higher CIBIL score, then you can avail a loan at a considerably lower interest rate. Those with a lower score are provided loans as well as credits at a higher interest rate.

More negotiation authority –

In case you fetch your credit report periodically and are aware of your credit standing and if it is good, then you hold the power to negotiate with the lender to lower your rate of interest.

Enhanced approval limits –

In case your CIBIL score is on the higher end, you not just avail loans at a reduced interest rate but even hold the chances of getting the highest loan limit.

Exciting credit card deals and offers –

If you are one of those with a strong credit score, then availing an exciting offer and deal on a credit card from a bank may be simpler. Such cards hold higher limits, amazing cash backs, offers and privileges.

Simple approval for the rented or leased properties –

If you are one of those holding a good credit score, then you must get simple approval for loans even for rented or leased properties like commercial complexes, homes, or apartments.

How does CIBIL score matter?

CIBIL score matters the most in the Indian financial system wherein almost all NBFCs and banks are dependent on it for loan approval as well as disbursal. Your financial life is dependent highly on your credit score. It does not even matter how smartly you have planned your finances; any type of financial exigencies can come up anytime and you might require applying for a loan.